Absolutely! Here’s a comprehensive 2500-word article about the best business virtual credit cards, with list items converted to headings for better structure and readability.

In today’s fast-paced digital economy, businesses of all sizes are seeking innovative solutions to streamline their financial operations. Virtual credit cards have emerged as a powerful tool for managing expenses, enhancing security, and improving overall financial control. This article delves into the world of business virtual credit cards, exploring their benefits, key features, and the top providers in the market.

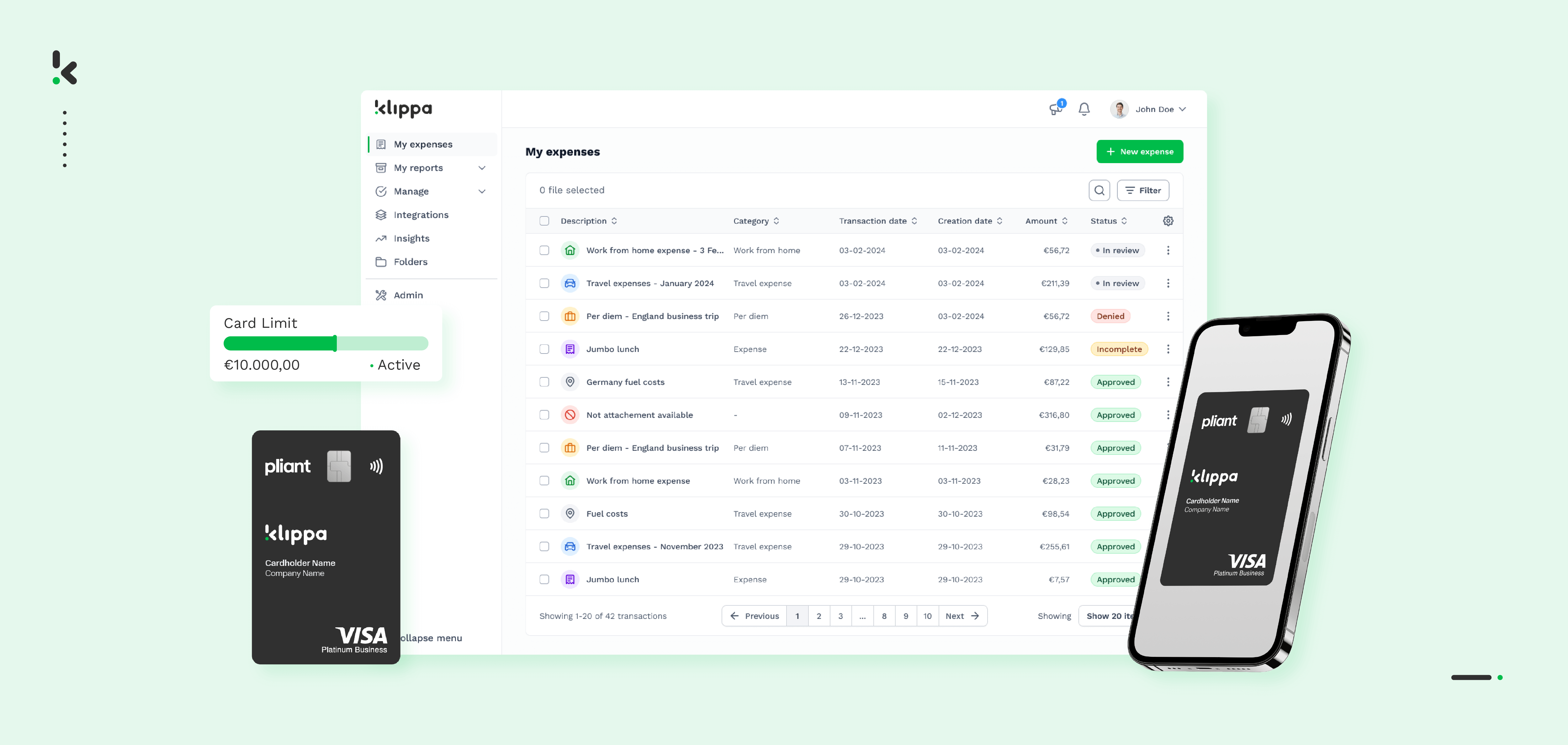

Virtual credit cards are digital, non-physical card numbers generated for specific transactions or purposes. Unlike traditional plastic cards, they exist solely in digital form, offering enhanced security and flexibility. They are typically linked to an existing business credit or debit card account, allowing businesses to create unique card numbers for various vendors, subscriptions, or online purchases.

Enhanced Security

Virtual card numbers are designed to be used for a single transaction or a limited period. This minimizes the risk of fraud or unauthorized charges, as the card number becomes useless after its intended purpose.

Improved Expense Management

Businesses can create unique virtual card numbers for different departments, projects, or vendors, making it easier to track and categorize expenses. This provides greater visibility into spending patterns and simplifies reconciliation.

Increased Control

Virtual cards allow businesses to set spending limits, expiration dates, and other parameters for each card number. This provides greater control over spending and helps prevent overspending or unauthorized transactions.

Streamlined Subscription Management

Managing recurring subscriptions can be challenging. Virtual cards enable businesses to create dedicated card numbers for each subscription, simplifying tracking and cancellation.

Simplified Online Purchases

Virtual cards provide a secure way to make online purchases, especially from unfamiliar vendors. This reduces the risk of exposing primary card details to potential fraudsters.

Ease of Integration

The virtual card provider should seamlessly integrate with existing accounting software and expense management systems.

Customizable Controls

Businesses should be able to set spending limits, expiration dates, and other parameters for each virtual card number.

Real-Time Reporting and Analytics

The provider should offer comprehensive reporting and analytics tools to track spending patterns and identify areas for cost savings.

Fraud Protection and Security Measures

Robust security measures, such as tokenization and encryption, are essential to protect sensitive card data.

Customer Support

Responsive and knowledgeable customer support is crucial for resolving any issues or concerns.

API Access and Automation

For larger businesses, API access and automation capabilities can help streamline workflows and integrate virtual cards into existing systems.

Brex Empower

Brex Empower offers a comprehensive suite of financial tools, including virtual cards, expense management, and travel booking. Their virtual cards allow businesses to create unlimited cards, set spending limits, and track expenses in real-time. Brex is known for its user-friendly interface and robust features.

Ramp

Ramp provides a corporate card and expense management platform with robust virtual card capabilities. Their virtual cards offer granular controls, real-time reporting, and seamless integration with accounting software. Ramp focuses on helping businesses save money and automate financial processes.

Divvy (Bill.com)

Divvy, now part of Bill.com, offers a powerful expense management platform with virtual cards. Businesses can create unlimited virtual cards, set budgets, and track expenses in real-time. Divvy is known for its intuitive interface and robust features.

Capital One Eno

Capital One Eno is a virtual card service that works in conjunction with Capital One business credit cards. It generates unique virtual card numbers for online purchases, enhancing security and preventing fraud. Eno is known for its simplicity and ease of use.

Privacy.com

Privacy.com specializes in virtual cards for online purchases. Businesses can create unique card numbers for each vendor or subscription, set spending limits, and pause or close cards at any time. Privacy.com is known for its focus on security and privacy.

Airbase

Airbase provides a comprehensive spend management platform that includes virtual cards, expense reimbursement, and accounts payable automation. Their virtual cards offer granular controls, real-time reporting, and seamless integration with accounting software. Airbase is designed for mid-market and enterprise businesses.

Mesh Payments

Mesh Payments offers a global spend management platform with virtual cards, automated reconciliation, and real-time reporting. Their virtual cards provide granular controls and seamless integration with accounting software. Mesh Payments is designed for businesses with international operations.

Extend

Extend allows businesses to generate virtual cards from their existing Mastercard business credit cards. It integrates with various accounting and expense management platforms, providing granular control and real-time reporting.

Emburse Abacus

Emburse Abacus provides expense management software with virtual card capabilities. It allows businesses to create virtual cards for specific projects or vendors, set spending limits, and track expenses in real-time. Abacus integrates with various accounting and ERP systems.

Teampay

Teampay offers a spend management platform with virtual cards, expense reimbursement, and approvals. It allows businesses to create virtual cards for specific teams or projects, set spending limits, and track expenses in real-time.

Selecting the right virtual credit card provider depends on the specific needs of your business. Consider factors such as:

Business Size and Industry

Smaller businesses may benefit from simpler, more affordable solutions, while larger enterprises may require more robust features and integrations.

Spending Patterns and Volume

Businesses with high transaction volumes or complex spending patterns may need providers with advanced reporting and analytics capabilities.

Integration Requirements

Ensure the provider integrates with your existing accounting software and expense management systems.

Budget and Pricing

Compare pricing plans and features to find a provider that fits your budget.

Customer Support and Reputation

Choose a provider with a strong reputation and responsive customer support.

Once you’ve selected a provider, implementing virtual credit cards is typically a straightforward process.

Sign Up and Account Setup

Create an account with the provider and link your existing business credit or debit card.

Configure Settings and Controls

Set spending limits, expiration dates, and other parameters for your virtual cards.

Generate Virtual Card Numbers

Create unique card numbers for specific vendors, subscriptions, or projects.

Integrate with Accounting Software

Connect the virtual card platform with your accounting software for seamless expense tracking.

Train Employees

Educate employees on how to use virtual cards and adhere to company policies.

Set Clear Spending Policies

Establish clear guidelines for using virtual cards, including spending limits, approval processes, and documentation requirements.

Monitor Transactions Regularly

Review transactions regularly to identify any unauthorized or suspicious activity.

Reconcile Expenses Promptly

Reconcile virtual card expenses with your accounting records on a regular basis.

Securely Store Card Information

Protect virtual card numbers and related information from unauthorized access.

Review and Update Settings

Periodically review and update virtual card settings to ensure they align with your business needs.

As technology continues to evolve, virtual credit cards are expected to become even more sophisticated and integrated into business financial operations. Future developments may include:

Enhanced Automation and AI

AI-powered tools may automate expense categorization, fraud detection, and other tasks.

Integration with Blockchain Technology

Blockchain technology could enhance security and transparency in virtual card transactions.

Increased Mobile Integration

Mobile apps will likely play an even greater role in managing and using virtual cards.

Global Expansion

Virtual card providers will likely expand their global reach, offering seamless cross-border transactions.

Business virtual credit cards offer a powerful solution for managing expenses, enhancing security, and improving financial control. By selecting the right provider and implementing best practices, businesses can leverage the benefits of virtual cards to streamline their financial operations and drive growth. As technology advances, virtual cards are poised to become an essential tool for businesses of all sizes.